Overview of the Market

The Miami housing market has been a focal point of interest for luxury home buyers and investors alike. This section provides an insight into the current trends and overall market stability.

Current Trends

Currently, Miami is characterized as a buyer’s housing market, with properties remaining on the market longer and prices generally lower compared to the previous year. This transition has created opportunities for potential buyers seeking luxury homes. The market is also experiencing resilience and growth, driven by migration patterns, economic factors, and strong demand across various price segments (Norada Real Estate Investments).

| Trend Category | Current Status |

|---|---|

| Market Type | Buyer’s Market |

| Price Trend | Lower than previous year |

| Days on Market | Longer than previous year |

Market Stability

Market stability in Miami is evidenced by a 1-year forecast predicting a 2.2% increase in housing prices, reflecting a steady and resilient environment despite economic uncertainties (Norada Real Estate Investments). Concerns about a potential real estate crash have been alleviated as sales prices increase at a rate comparable to rental prices, indicating that the market is not in a bubble. This stability is further highlighted by the market’s ability to adapt to rising interest rates, maintaining its resilience.

| Stability Indicator | Current Observation |

|---|---|

| 1-Year Price Forecast | 2.2% Increase |

| Market Bubble Status | Not in a bubble |

| Resilience to Interest Rates | Stable despite increases from 3% to 7% |

The Miami housing market continues to attract attention, especially among those looking for Miami luxury homes and Miami penthouses for sale. As the market evolves, it remains essential for buyers to stay informed about the latest trends and developments to make well-informed decisions.

Pricing Insights

Understanding pricing dynamics is essential for anyone looking to invest in the Miami housing market, particularly in the luxury segment.

Median Home Prices

As of July 2024, the median home sold price in Miami was $554,851, reflecting an 8.5% increase from the previous year. For single-family homes in Miami-Dade County, median prices rose from $620,000 to $650,000, marking a 6% year-over-year growth (Norada Real Estate Investments). In addition, existing condo median prices in the area increased by 2.4%, from $415,000 to $425,000 (Norada Real Estate Investments).

| Property Type | Median Price | Year-over-Year Change |

|---|---|---|

| Single-Family Homes | $650,000 | +6% |

| Condominiums | $425,000 | +2.4% |

| Overall Residential | $554,851 | +8.5% |

Price Per Square Foot

The price per square foot is another critical metric for evaluating real estate investments. The median price per square foot in Miami stands at $386. The average sale price in the region is approximately $560,000, with an average price per square foot of $469 (SoFi). This data indicates a general upward trend in both median and average prices, highlighting the desirability of Miami properties.

| Property Type | Price Per Square Foot |

|---|---|

| Median | $386 |

| Average | $469 |

Investors and homebuyers interested in Miami luxury homes should keep these pricing insights in mind when navigating the competitive housing landscape. Understanding the nuances of the Miami real estate market can help in making informed decisions regarding property investments.

Buyer Opportunities

The Miami housing market currently presents several opportunities for potential buyers, particularly those interested in luxury homes. With a significant portion of properties selling below their asking prices and an increase in the average days on the market, buyers may find favorable conditions for negotiating better deals.

Homes Below Asking Price

As of July 2024, an impressive 72.6% of homes in Miami were sold below their asking price, indicating a substantial opportunity for buyers to secure properties at more affordable rates (Rocket Homes). This trend suggests that buyers can negotiate effectively, making it an advantageous time to enter the market.

| Month | Percentage of Homes Sold Below Asking Price |

|---|---|

| July 2024 | 72.6% |

| Previous Year | Data not specified |

Given this high percentage, buyers are encouraged to conduct thorough market research and engage experienced Miami luxury real estate agents to help navigate negotiations and identify properties that may be undervalued.

Days on Market

The average days on the market for homes in Miami has reached approximately 57 days as of July 2024. This represents a 7.8% increase compared to the previous year. The extended time frame indicates that the market is currently favorable to buyers, as homes are staying listed longer, providing ample opportunity for assessments and negotiations.

| Month | Average Days on Market |

|---|---|

| July 2024 | 57 days |

| Previous Year | Increase of 7.8% |

In a market characterized as a buyer’s market, prospective buyers can take advantage of the longer listing periods to make informed decisions without the pressure of fast-paced sales. This allows for thorough inspections and evaluations of potential homes, which is particularly important when considering luxury properties.

The current conditions in the Miami housing market highlight the opportunities available for buyers seeking luxury homes. With many listings selling below asking prices and an increase in the average days on the market, it is an opportune time for savvy buyers to explore their options and potentially secure their dream homes at favorable prices. For more insights on luxury real estate, consider exploring our sections on Miami luxury homes and Miami real estate market trends.

Luxury Home Features

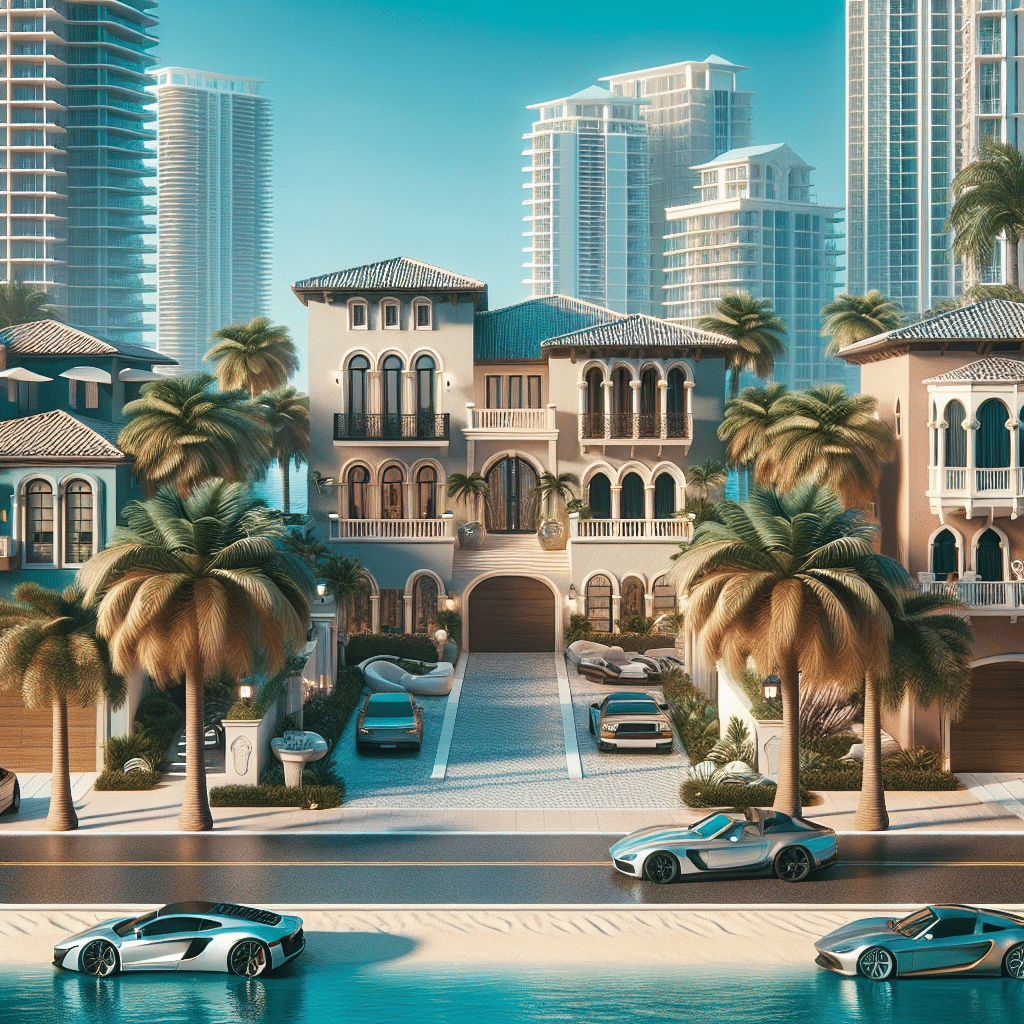

When exploring the luxury real estate market in Miami, potential buyers should be aware of the key characteristics that define luxury homes, as well as the most sought-after locations for these properties.

Characteristics of Luxury Homes

Luxury homes in Miami are characterized by a combination of high-end finishes, spacious layouts, and premium amenities. Some defining features often found in these properties include:

| Feature | Description |

|---|---|

| Square Footage | Luxury homes typically offer expansive floor plans, often exceeding 3,000 square feet. |

| High-End Materials | Use of premium materials such as marble, granite, and custom cabinetry is prevalent. |

| Smart Home Technology | Many luxury residences are equipped with advanced home automation systems for security and convenience. |

| Outdoor Spaces | Features like private pools, landscaped gardens, and outdoor kitchens enhance the living experience. |

| Scenic Views | Properties often boast breathtaking views of the ocean, skyline, or lush landscapes. |

The demand for luxury homes in Miami is driven by factors such as location, architectural design, and the overall lifestyle offered by these properties. Notable developments, such as Miami waterfront homes and luxury condos, often highlight these characteristics.

Popular Locations

Several neighborhoods are particularly renowned for their luxury real estate offerings. Below are some of the most popular areas for luxury homes in Miami:

| Location | Notable Features |

|---|---|

| Miami Beach | Known for its oceanfront properties and vibrant nightlife, Miami Beach is a prime destination for luxury living. |

| Coral Gables | This area is famous for its Mediterranean-style mansions and tree-lined streets, providing a suburban feel close to the city. Coral Gables mansions are a highlight here. |

| Star Island | An exclusive neighborhood featuring waterfront estates and celebrity homes, Star Island is synonymous with luxury. Check out Star Island homes for sale for available listings. |

| Brickell | Known as Miami’s financial district, Brickell offers luxurious high-rise condos with stunning views of Biscayne Bay. Explore Brickell luxury real estate for current listings. |

| Key Biscayne | This island community offers a laid-back lifestyle with upscale waterfront properties, perfect for families and retirees alike. |

The Miami housing market continues to flourish, with strong demand for luxury homes and new developments addressing inventory shortages. For those seeking high-end properties, understanding the features and locations that define luxury living in Miami is essential.

Neighborhood Highlights

Key Areas in Miami

Miami boasts a variety of neighborhoods, each offering unique characteristics and housing trends. Below are some of the notable areas in the Miami housing market, along with their average sale prices and price per square foot.

| Neighborhood | Average Sale Price | Price Per Square Foot |

|---|---|---|

| Coral Way | $635,000 | $476 |

| Northeast Coconut Grove | $1,570,000 | $718 |

| Wynwood | $535,000 | $585 |

| Overtown | $453,000 | $431 |

| Downtown Miami | $585,000 | $609 |

Each of these neighborhoods caters to different preferences and budgets, making Miami a diverse market for luxury homes. For instance, Northeast Coconut Grove is recognized for its upscale residences, while Wynwood is known for its vibrant art scene and cultural appeal.

Market Trends by Area

Currently, Miami is experiencing a buyer’s housing market. Prices are generally lower, and homes are remaining on the market longer compared to previous years (Rocket Homes). This trend allows potential buyers to explore various options without the pressure of rapidly rising prices.

Despite Miami being labeled as one of the most overvalued housing markets in the U.S., it ranks third globally on the 2023 Real Estate Bubble Index by UBS. However, factors such as strong demand and limited housing supply are contributing to a stabilization trend in the market (Lux Life Miami Blog).

The Miami real estate market is currently in the expansion phase of the real estate cycle, which has been ongoing since 2010. This phase has lasted longer than typical, indicating resilience and growth in the market.

As prospective buyers consider entering the market, understanding the specific dynamics of each neighborhood will be essential for making informed decisions. For more information on luxury real estate options, explore our sections on Miami luxury homes and Miami condo investments.

Economic Factors

Understanding the economic factors influencing the Miami housing market is essential for potential buyers, especially those seeking luxury homes. This section will cover migration patterns and the cost of living in the area.

Migration Patterns

Miami has become a highly sought-after destination for many individuals and families, ranking No. 1 on Redfin’s 2023 list of the most popular migration destinations among metropolitan areas in the United States. This trend is primarily driven by the pivot to remote work and an influx of residents and businesses relocating from other states (SoFi). The ongoing migration is contributing to the resilience and growth of the local housing market, leading to increased demand for luxury properties.

The following table outlines key migration trends influencing the Miami housing market:

| Year | Migration Increase (%) |

|---|---|

| 2021 | 15% |

| 2022 | 20% |

| 2023 | 25% |

Cost of Living

The cost of living in Miami is a significant consideration for prospective residents. According to the Council for Community and Economic Research’s 2022 Cost of Living Index, Miami-Dade County has a cost of living approximately 20.6% above the national average. This elevated cost is reflective of the luxurious lifestyle and amenities available in the area.

To live comfortably in Miami, individuals are advised to have a minimum salary of at least $150,000, though a higher income would be beneficial to ensure a shorter commute and a more comfortable lifestyle (Quora).

The demographic overview of residents in Miami further highlights the economic landscape:

| Metric | Value |

|---|---|

| Median Income | $47,860 |

| Median Age | 39.9 years |

| College Educated | 33.1% |

| Homeownership Rate | 30% |

| Married Residents | 40.7% |

These economic factors significantly impact the luxury real estate market in Miami, influencing buyer preferences and shaping the availability of luxury homes. For those interested in specific properties, exploring options such as Miami luxury homes and Miami waterfront homes for sale can provide insights into the market’s offerings.

Future Projections

Price Forecasts

The Miami housing market is projected to experience a 2.2% increase in prices over the next year, indicating a stable and resilient market despite prevailing economic uncertainties. While there has been a slowdown in sales, most properties in Miami are not expected to see price reductions in 2024. Overpriced listings may start to drop, but genuine deals below market value are unlikely due to the overall stable market conditions and low foreclosure rates.

| Year | Projected Price Increase (%) |

|---|---|

| 2024 | 2.2 |

Despite some concerns about a potential real estate crash, the market is not considered to be in a bubble. Sales prices are increasing at a rate comparable to rental prices, suggesting that these prices are supported by market fundamentals and affordability. The resilience of the Miami real estate market is demonstrated by its response to rising interest rates, with entrance prices continuing to rise even as rates climbed from 3% to 7% (Lux Life Miami Blog).

Market Sustainability

The sustainability of the Miami housing market is underscored by its consistent price growth, even in the face of rising interest rates and a slowdown in rental prices. According to real estate economist Ken H. Johnson from FAU’s College of Business, while price growth may be tepid due to these factors, the overall market continues to thrive (GlobeSt).

The current market characteristics suggest that it is robust enough to withstand economic shifts. Low foreclosure rates and a steady influx of buyers contribute to the market’s stability, maintaining a healthy demand for luxury properties in Miami. For those seeking to invest in Miami luxury homes, the enduring demand and projected price increases may present advantageous opportunities in the near future.

Overall, the Miami housing market remains resilient and sustainable, with continued growth expected in the luxury sector. For further insights into investment opportunities, consider exploring Miami condo investments or Miami penthouses for sale.

Challenges for Buyers

Navigating the Miami housing market presents distinct challenges for prospective buyers, particularly in the luxury segment. Two significant hurdles include inventory shortages and rising costs.

Inventory Shortages

The Miami real estate market is currently experiencing a notable shortage of housing inventory. This issue is compounded by a national deficit of approximately 4 million housing units, a situation that has persisted since the housing crash of 2007. The construction slowdown that followed has led to a tight market, particularly in Florida, where land constraints limit the development of new properties. In Miami, the focus has shifted towards the construction of condominiums to address this shortage (Lux Life Miami Blog).

As a result of these inventory challenges, buyers may find it difficult to locate suitable luxury homes. The combination of high demand and limited supply often leads to competitive bidding situations, driving up prices for the available properties. Buyers interested in luxury homes, such as those on Star Island or in other exclusive neighborhoods, may face particularly stiff competition.

| Market Factor | Current Condition |

|---|---|

| Housing Inventory | Shortage |

| Construction Focus | Condominiums |

| National Housing Deficit | 4 million units |

Rising Costs

Despite a recent slowdown in property appreciation and some price reductions in the luxury sector, costs remain a significant concern for buyers. The Miami housing market has seen consistent price increases, which are not expected to decline substantially in 2024. While overpriced listings may experience reductions, genuine deals below market value are unlikely due to stable market conditions and low foreclosure rates (Lux Life Miami Blog).

The combination of rising costs and ongoing demand can make it challenging for buyers, especially those seeking high-end properties. The luxury market continues to attract affluent buyers, which contributes to maintaining higher price points. As a result, potential buyers should remain vigilant and prepared to act quickly when suitable properties become available. For insights on luxury real estate options, including Miami penthouses and waterfront homes, it is advisable to consult with experienced real estate agents familiar with the nuances of the Miami market.

| Cost Factors | Current Trends |

|---|---|

| Overall Price Movement | Stable with potential reductions for overpriced listings |

| Market Demand | High, particularly for luxury properties |

| Foreclosure Rates | Low |

Understanding these challenges is essential for buyers looking to invest in the Miami housing market, particularly in the luxury segment.